WHY SELF-STORAGE

Self-Storage

Investing in self-storage can be a rewarding venture for a variety of reasons. Some of the key reasons that make self-storage a compelling investment; Steady Income Stream, Low Operating Costs, Flexibility in Unit Sizes, Low Client Turnover, Simple Management, Appreciation Potential, Diverse Customer Base, Value-Add Opportunities.

BENEFITS OF INVESTING IN SELF STORAGE ASSETS

Tax Benefits

Self-storage investors may take advantage of tax benefits including multiple depreciation strategies

Benefits

Investing in self-storage can provide benefits over investing in other commercial real estate investments which include low start-up costs, stable client occupancy and low operating costs.

Hedge Against Inflation

Self-storage real estate can be a good hedge against inflation because it is recession-resistant and has short-term leases. Real estate investments are natural hedges against inflation because the value of real property tends to rise over time with increases in the Consumer Price Index (CPI).

Hedge Against Recession

During economic downturns, people downsize or move, which increases demand for storage units. The pandemic was an example of this phenomenon. Self-storage is also a conservative investment that offers investors more stability than traditional investments in stocks. It provides a stable, predictable income stream, low maintenance, and low operating costs compared to other types of real estate assets.

BENEFITS OF INVESTING IN SELF STORAGE ASSETS

Tax Benefits

Self-storage investors may take advantage of tax benefits including multiple depreciation strategies

Benefits

Investing in self-storage can provide benefits over investing in other commercial real estate investments which include low start-up costs, stable client occupancy and low operating costs.

Hedge Against Inflation

Self-storage real estate can be a good hedge against inflation because it is recession-resistant and has short-term leases. Real estate investments are natural hedges against inflation because the value of real property tends to rise over time with increases in the Consumer Price Index (CPI).

Hedge Against Recession

During economic downturns, people downsize or move, which increases demand for storage units. The pandemic was an example of this phenomenon. Self-storage is also a conservative investment that offers investors more stability than traditional investments in stocks. It provides a stable, predictable income stream, low maintenance, and low operating costs compared to other types of real estate assets.

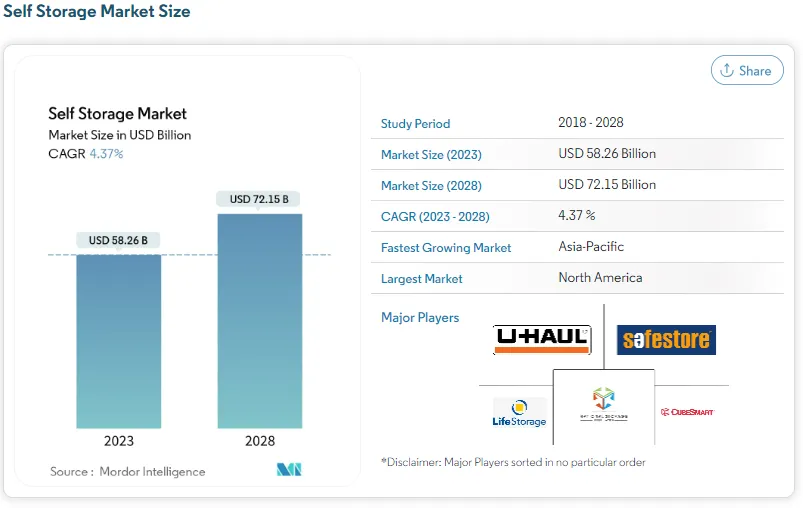

The self-storage market is expected to reach USD 58.26 billion in 2023 and grow at a CAGR of 4.37% to reach USD 72.15 billion by 2028

Learn How To Become An Investor With Us

We welcome inquiries from investors seeking self storage investment opportunities.

Helpful Links

Contact Information

Location: Windsor, CO

Phone: (970) 550-2970

Email: info@8thhousecapital.com

©2024 8th House Capital All Rights Reserved.

©2026 8th House Capital. All Rights Reserved.